Competition - International Railway Summit

Railway Modernisation – Standards are necessary to ensure quality, safety & economies of scale

India is a vast country, not only in terms of its diverse cultural landscape but also the length, the breadth and the various topographies one encounters while travelling. Indian Railways, though a legacy of its colonial past, has evolved to become the lifeline of the country, catering to its needs for large scale movement of traffic, both freight and passenger, thereby contributing to economic growth and promoting national integration. In fact, railways constitute the backbone of the surface transport system in India. Today, Indian Railways are the fourth largest railway network in the world, operated by the Ministry of Railways, the Government of India, and one of the largest public sector undertakings.

Rail has several strengths such as being safe, more environmentally friendly and less polluting than other modes of transport — a significant advantage at a time of increasing congestion on roads and growing public concern about environmental issues.

However, the railways need to become more efficient, integrated, modern and responsive to customer demand. Building a modern, competitive railway network is indeed a top priority for India, both for smooth operation and for the development of a sustainable transport system. In line with this commitment to sustainability, the government has committed to electrify its entire rail network by 2023 and become a “net-zero carbon emitter railway” by 2030.

The high speed, modern rail services will be riding on new technology such as signalling, communication and other IT tools. It is therefore imperative at this stage that we understand the importance and role of standards, and the need to harmonise standards with the International and/or regional standardisation bodies.

What Global/Regional Standards should be chosen, harmonisation, and why it is necessary

Taking a leaf from the European Standardisation bodies CEN-CENELEC, in Europe, harmonisation means 1 standardised solution instead of 34 and whenever possible, Europe’s preference is to go for 1 global solution developed by ISO/IEC.

The objective behind adoption of harmonised or global standards is to avoid duplication of work, both at the International as well as at the European level. This also essentially means that having ISO/IEC standards-based solutions encourages competitiveness amongst manufacturers, opens global markets for trade and exchange of services, and brings economies of scales.

Harmonisation of standards is beneficial not only for the country, but it is advantageous for all the stakeholders around the world as it ensures the quality and safety of products & services, thereby increasing the reliability, safety and satisfaction of customers’ expectations and requirements. Harmonised standards also result in reduced costs, by eliminating waste and improving efficiency, thereby saving government/private spending.

Harmonised standards help in opening global markets, ensuring compliance with national and international legislations/regulations, as well as providing knowledge about new technologies and innovation.

Due to its global competitiveness, European standards are adopted in 15 countries beyond CEN and CENELEC membership, as well as at the regional level in the Gulf. China, Mongolia, Kazakhstan, Georgia, Ukraine, Moldova, Belarus, Egypt, Tunisia, Morocco, Albania, Montenegro, Bosnia & Herzegovina, South Africa and Botswana have also adopted many European rail standards as well.

In India, the railway standards and specifications for all the important verticals like communications, signalling, electric power system, rolling stock, etc. are aligned/referred/implemented 70% – 100% with European or Global standards.

As we progress towards the modernisation of the Indian Railways, integration with global standards / European standards is the most desirable way forward for Indian Railways to be at a par with its International counterparts.

A copy of Mr Sharma’s presentation delivered at the 8th International Railway Summit is available here

About SESEI:

The Seconded European Standardisation Expert for India (SESEI) project is supported and operated by the European Committee for Standardisation (CEN), the European Committee for Electrotechnical Standardisation (CENELEC) and the European Telecommunications Standards Institute (ETSI), as well as by the European Commission (EC) and by the European Free Trade Association (EFTA). Its general objective is to raise awareness on the European Standardisation System, values and assets in India.

SESEI’s mission is to enhance the visibility of European standardisation activities, increase the cooperation between Indian and European standardisation bodies and support European companies facing standardisation related issues hampering market access to India. The project also supports India in standardisation related aspects of its integration in the WTO trading system, by identifying all potential opportunities for enhanced international cooperation and global harmonization of standards. Ultimately, the SESEI project aims at reducing the Technical Barriers to Trade (TBT) both between EU and India and globally, thus supporting European and Indian industries by facilitating international trade.

Does competition benefit customers?

Carole took part as a speaker at the 6th International Railway Summit in Prague in a panel discussion addressing whether competition benefits customers. Carole represented the perspectives of the private and independent freight operator members of the European Rail Freight Association (ERFA).

The European Rail Freight Association (ERFA) is an association which represents private and independent railway companies from across Europe. ERFA aims to achieve the best conditions for a competitive railway sector. Our mission is to promote rail transport as a first and viable choice for customers, and to ensure full market opening of rail across all of Europe. ERFA’s objective is to represent the voice of new market entrants in Europe. We support the EU decision-making process with a focus on policy and technical affairs. Our focus is on generating growth for demand in rail services and shifting more goods onto eco-friendly rail.

We represent more than 1/3 of the rail freight market share.

ERFA’s existence and activities are based on this conviction: competition in a healthy environment benefits customers. Our members are competing between each other for customers because they are convinced that they can bring an added value to customers, and their continuous growth has demonstrated that they can.

Within ERFA, we favour competition as away to meet customer needs. European policy takes note that a monopoly situation fosters pricing distortion: limited customer orientation and unsustainable business models. Let’s take for instance the French situation audited in the Spinetta Report that concludes that the current SNCF business model has to be adapted and that competition has to be developed on the French market.

Competition and the existence of private operators on the market have many advantages. Among them, monopoly service providers will never have the same pressure to decrease prices, improve quality, innovate, as when they are competing with other companies for customers. Better quality creates pressure for higher performance. Also, better price drives down costs.

Moreover, we have in mind that innovation is beneficial to drive the development of superior products for the market. We think that information availability creates the climate for enhancing customer communication. We want customers to have the power to make choices: if a customer is unhappy with one Railway Undertaking, he has other options.

To conclude, competition in a healthy Market environment benefits customers; but healthy competition is still not the case in most EU countries today! In most EU countries one dominant market player, normally the state-owned incumbent, trounces the competition with the nearest, biggest competitor trailing far behind. This should be not the case if the right framework conditions were in place to support sustainable business models for freight. So yes, rail freight is open to competition today, but still not able to deliver the products needed by the market.

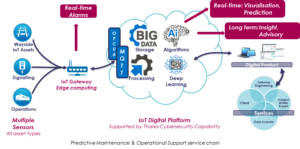

Leveraging the Internet of Things to enable a smart rail infrastructure

Etienne, networks and telecommunications expert at Thales Ground Transportation Systems, presented how the Internet of Things (IoT) can improve operational and monetary efficiency at the 5th International Railway Summit in Kuala Lumpur.

The railway industry is going through a digital transformation due to recent challenges around increased competition from other transportation methods while coping with limited resources.

Better performance is expected to satisfy the increasing traffic demand in congested cities, leading to optimum utilisation of existing infrastructures. Achieving this within decreasing budgets means better returns on assets, simplified wayside systems and lower maintenance costs. Meanwhile, required efficiency improvements call for more integrated Operation Control Centres, automated with new data-driven functionalities, enabling infrastructure operators to quickly react to incidents. Finally, improving passenger experience is fundamental, while maintaining compliance with safety regulations and cyber security to mitigate new threats created by digitalization.

Rail Infrastructure Managers must at the same time:

• Improve safety conditions and reduce service disruptions,

• Maximize asset availability and increase operations efficiency,

• Optimize the financial return on assets and manage decreasing overall budgets.

This leads to stringent operational requirements for rail infrastructures. Achieving this requires a paradigm shift. To succeed, the industry must develop decision support tools that provide a comprehensive view of the infrastructure and integrate information from increasingly disparate systems. All this leads to smarter maintenance regimes – moving from break and fix to predict and prevent.

This in itself is nothing new. Defence, Aeronautics and Space have developed Health and Usage Monitoring Systems (HUMS) to increase availability and minimize breakdown risks. Applying this model to the railway industry enables predictive maintenance, where failures are anticipated and repaired before service disruption, optimising not only performance but also safety and cost.

These new capabilities rely on new technologies such as the Industrial IoT, Big Data Analytics and Cloud technologies. Data generated by sensors is collected through versatile networks fit to field conditions, then fed into a cloud infrastructure supported by Big Data Analytics frameworks.Relying on Artificial Intelligence and Deep Learning algorithms, data scientists and subject matter experts combine technical savvy and unparalleled interpretation skills to create insights.

Transforming raw data into knowledge is not easy though. This requires strategic choices like sensors with proper data normalization and formatting, and efficient diagnostic rules. The network and IT architecture should use a good balance of distributed and centralized processing, relying on a scalable IIoT platform, modular enough to accommodate technology evolutions and context-specific operational choices. Cybersecurity is, of course, central to the solution, from sensors up to the application front-ends. These solutions must be scalable with real-time capabilities to enable fast response. A consolidated view of the information also supports immediate monitoring and long-term strategy.

The Industrial IoT model will help railway industry to benefit from predictive maintenance, real-time diagnostics and long-term process optimization. From an integrator’s standpoint, modularity and independence from technology are paramount to ensure future-proofing, and adaptability to diverse Rail Infrastructure manager’s needs.

Then a predictive maintenance solution will significantly improve maintenance costs, downtime and unplanned events. For the maintenance teams, this will also improve work conditions, focussing on high value tasks. Eventually, right-first-time repairs, enabled by accrued anticipation capacities, will minimize time spent on trackside and increase safety conditions.

Better services for happier customers?

Libor, Executive Director of CER, spoke about increasing the attractiveness of rail for customers at the 6th International Railway Summit in Prague, and about sector expectations regarding the Fourth Railway Package at the 2nd International Railway Summit in Barcelona.

Libor will speak at the 7th International Railway Summit about utilising data more efficiently to achieve better outcomes.

A look at the rail sector… and beyond.

Over the last decade, European rail observers saw a steady passenger market share increase in rail services in the European Union, with a 1.5% average increase per year of rail services demand. 9.7bn passengers were carried in 2016 by the CER members, accounting to roughly 90% of the European rail passenger market. When it comes to high-speed rail, 80% of passengers chose rail over aviation for journeys of up to 2.5 hours.

Europe’s rail operators know very well that existing markets can perform even better. New markets could be conquered if the operators are able to take full advantage of the digitalisation of the economy: easier and faster ticketing services integrated with door-to-door solutions for passengers are certainly areas in which many efforts are being made by the sector.

However, it should not come as a surprise that rail services and customer satisfaction also depend on broader basic conditions. While market opening is an essential piece of a wider policy architecture, there are, today, still certain other fragile pillars.

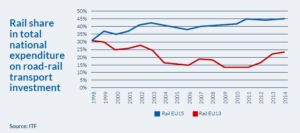

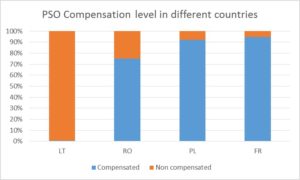

Source graph 1: CER Facstsheet ‘The future of transport investments – what MFF do we need?’

Source graph 2: Data used from CER PSO brochure

Adequate funding and effective financing are at the bottom of all problems.

Infrastructure financing has been increasing over the years, and the current Connecting Europe Facility budget helped a great deal to fill the gaps of the past. Yet national rail infrastructure budgets are insufficient, especially in the Eastern part of the EU. On top of that: how can train operators provide high quality rolling stock when public authorities do not respect the financial commitments of public service contracts? Last but not least: how can we expect rail services to be price-competitive versus cars and buses when trains must pay infrastructure charges for every single kilometer of line they travel, when road users don’t?

The ones who are looking for polemic objectives should for once not limit their sight to railway companies nor to EU institutions.

For example, the proposal of the European Commission for the next Multiannual Financial Framework seems to confirm the commitment of the EU towards an ever cleaner European transport system, and the proposal on the revision of the road charging directive published in May 2018 (as part of the first Mobility Package) was a big step in the right direction towards guaranteeing a level playing field for all land transport operators. These two dossiers will now be discussed at the Council of the EU by the EU Member States. That will be the place where the real ambitions of EU governments will be measured. What we hear from the rooftops, these discussions may take a different turn.

It is CER’s objective to insist on national governments to respond to the Commission’s ambition with even greater ambition. National governments need to couple political wisdom with adequate commitments to greening Europe’s mobility chain. Being the greenest and safest mode of land transport, rail should be part of the solution.

Competition in Railways

Roger offered his great expertise within transport economics as moderator of a panel discussion entitled “Does competition benefit passengers?” at the 6th International Railway Summit in Prague.

For most of the period since the Second World War, up until the end of the twentieth century, railways in Europe were largely provided by state-owned operators. During almost all of this period these railways were in decline in terms of both passengers carried and freight moved. There were bright spots, such as the introduction of high-speed services, but largely rail was squeezed between road for shorter journeys and air for longer journeys.

Since the turn of the century the picture has changed to a degree. Encouraged by the privatisation of the railways in Japan, and then in Britain, the European Union embarked on a series of four railway packages all designed to introduce competition. The main elements of these various packages were: to separate track and operations so that there was transparency in track access charges; to allow for competition in the provision of rail services, either through open access or through competitive tendering; to open up national markets to foreign operators.

The 6th International Railway Summit in Prague in February 2018 offered an ideal opportunity to reflect on the degree of success of these changes. Bringing together a panel from the European Commission, the Community of European Railways, UK passenger and freight operators, and both the incumbent national operator and an open access entrant in the Czech Republic, this allowed for a comparison between different ways the packages have been implemented.

Although the headline message has been one of success in helping towards the revitalisation of railways, not least through greater levels of investment than had been possible by state-owned railways, it has become clear that there remain many difficult areas that constrain rail from being able to compete on a level playing field with other modes of transport.

Open access operators providing direct competition on the track still face problems of getting that access when slot allocation remains largely dominated by incumbent operators. Even where slots are obtained such operators may find it challenging to secure exposure on online ticketing sites. Franchised operations continue to run the risk that, in order to gain a franchise, potential operators are encouraged to overbid and then run into difficulties if projected traffic increases do not materialise – an outcome known as “the winner’s curse”.

Freight operators continue to find themselves behind passenger operators in the fight for access to networks. Whilst international passenger traffic has benefited, largely through the setting up of specialised operators providing through services, international freight has remained less well integrated. The opening up of national markets to competition from foreign operators has had mixed success.

The conclusion must be that although much progress has been made and there are undoubted successes, this progress remains patchy across Europe. State supported incumbent operators remain dominant in most countries and rail’s market share remains disappointingly low despite the growth of traffic. Often competition has introduced confusion for passengers, compounded by the lack of integrated ticketing.

Perhaps the main lesson for policy makers is that simply introducing competition in one transport mode does not level the playing field for competition with other modes and may, in some cases, actually hinder it.